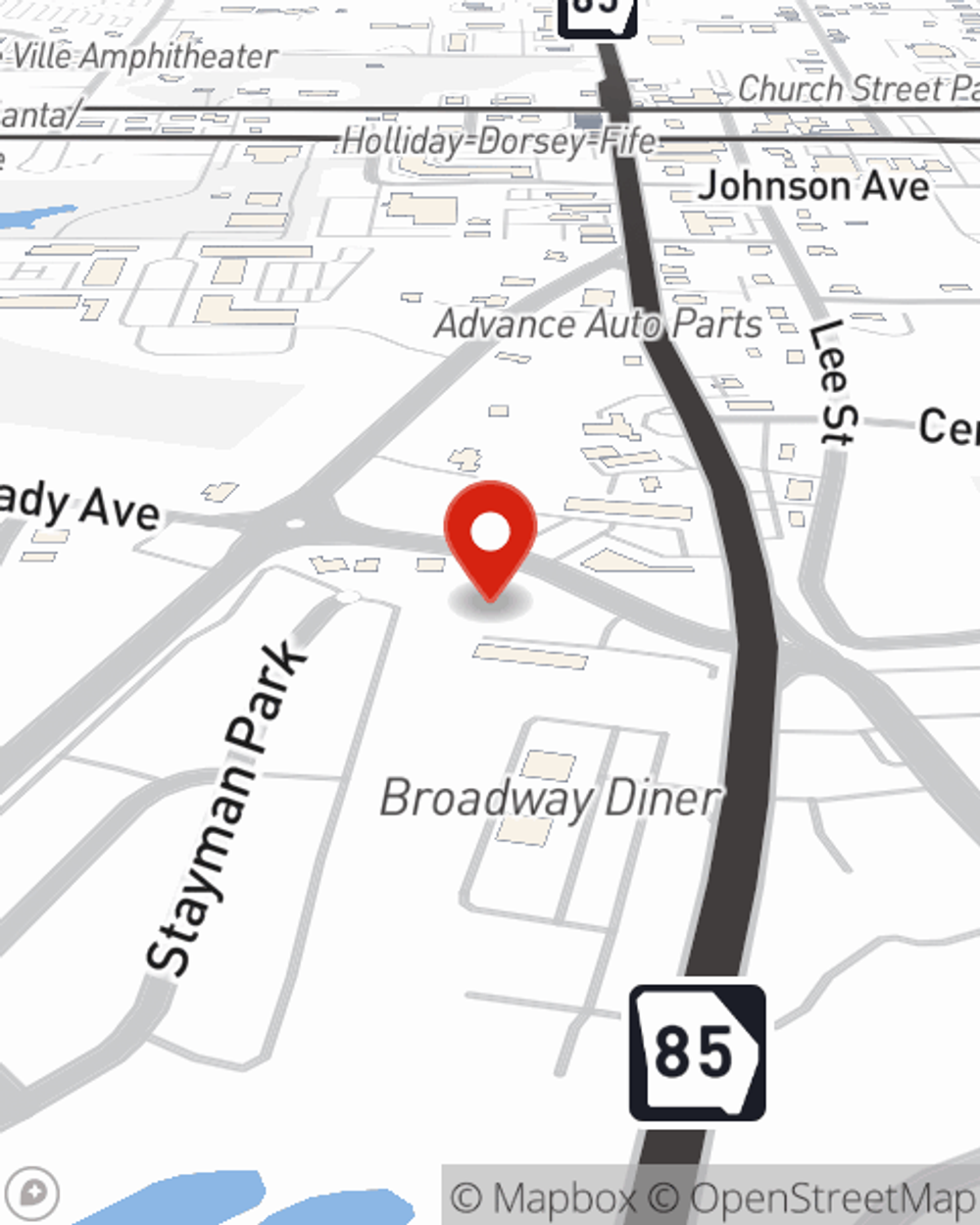

Renters Insurance in and around Fayetteville

Get renters insurance in Fayetteville

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Fayetteville

- Senoia

- Coweta

- Fayette

- Peachtree City

- Bibb

- Paulding

- Henry

- McDonough

- Griffin

- Hampton

- Tyrone

- Forsyth

- Brooks

- Sharpsburg

- Woolsey

- Newnan

- Luthersville

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is a wise idea, whether or not your landlord requires it.

Get renters insurance in Fayetteville

Renters insurance can help protect your belongings

Agent Bubba Ruppe, At Your Service

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a property or space, you still own plenty of property and personal items—such as a desk, stereo, a video game system, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why get renters insurance from Bubba Ruppe? You need an agent who wants to help you understand your coverage options and choose the right policy. With wisdom and skill, Bubba Ruppe is here to help you discover the State Farm advantage.

Renters of Fayetteville, contact Bubba Ruppe's office to explore your personalized options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Bubba at (678) 545-0036 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Bubba Ruppe

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.